maximbregnev.ru

Overview

How To Find Old Airline Tickets

It's easy to find tickets and receipts from all your bookings within the past three months. Simply enter your booking details below. Matrix, ITA's original airfare shopping engine, has yielded years of Matrix Airfare Search. brightness_6. Find your flight. Round Trip. One Way. Multi. On booklet tickets, the airline code and ticket number is located at the bottom center of the ticket. In the example below, you would enter in the. Matrix, ITA's original airfare shopping engine, has yielded years of Matrix Airfare Search. brightness_6. Find your flight. Round Trip. One Way. Multi. The ticket, in either form, is required to obtain a boarding pass during check-in at the airport. Then with the boarding pass and the attached ticket, the. original ticket. eTicket Flight Credits cannot be transferred to another What else should I know about mistakes and name changes on my airline tickets? Records of flight itineraries are only stored for 12 months and we will need your confirmation code to locate it in our archive. If you booked through an agency. You can find the reservation code on your ticket, schedule or on our sleeve. It's also known as a "PNR" or "Record Locator". If you do not know the booking. Enter your information to look up a trip. You can search by confirmation number, credit/debit card number or ticket number. All fields required. Find Your. It's easy to find tickets and receipts from all your bookings within the past three months. Simply enter your booking details below. Matrix, ITA's original airfare shopping engine, has yielded years of Matrix Airfare Search. brightness_6. Find your flight. Round Trip. One Way. Multi. On booklet tickets, the airline code and ticket number is located at the bottom center of the ticket. In the example below, you would enter in the. Matrix, ITA's original airfare shopping engine, has yielded years of Matrix Airfare Search. brightness_6. Find your flight. Round Trip. One Way. Multi. The ticket, in either form, is required to obtain a boarding pass during check-in at the airport. Then with the boarding pass and the attached ticket, the. original ticket. eTicket Flight Credits cannot be transferred to another What else should I know about mistakes and name changes on my airline tickets? Records of flight itineraries are only stored for 12 months and we will need your confirmation code to locate it in our archive. If you booked through an agency. You can find the reservation code on your ticket, schedule or on our sleeve. It's also known as a "PNR" or "Record Locator". If you do not know the booking. Enter your information to look up a trip. You can search by confirmation number, credit/debit card number or ticket number. All fields required. Find Your.

Domestic flight fares vary depending on boarding time, time, and section, so you can pay the difference between new and previous journey. New ticket can be. View your itinerary, make changes, or cancel flights. Confirmation code Forgot your confirmation code or ticket number? HawaiianMiles members can. Eticket query & resend service is available only for an unused or partially used CI/AE international flight ticket which was purchased on this website or CI/AE. To find the change rules for your flight ticket, look under the My Trips section of your account. Change penalties will be listed underneath your itinerary. Click on My Account then visit the Trips tab. You'll see your past flight(s) and can get the purchase details for your flight by clicking on the trip name. Your ticket number is a digit number that uniquely identifies the airline ticket that was issued to you. The quickest and easiest way to locate your. original ticket to determine the eligibility and the unused value of the ticket) Airlines ticket credits by clicking the Add Ticket Credit option in. CheckMyTrip is your digital travel assistant, bringing you trip itinerary, flight alerts, travel services and extras in one place to get you smoothly from door. Displayed fares are based on historical data, are subject to change and There are several hacks you can use to get cheap round trip plane tickets. This page contains information on tickets for international flights. We check tickets and e-ticket itineraries/receipts at departure lobby and. If you booked a flight through an airline's website or through an online travel service like Expedia or Kayak, you'll find your reservation details in your. Find. Search site. Find. Expand search box. Flight Search. Special Offers. Book Book. Book Travel; Routes and Partners; Flight Passes; Fare Options and Fees. Airfare history charts - See how fares vary over time Choosing the right tine for your flight is critical, so that you can get a cheap airplane tickets. If you are at the airport, simply go to the Emirates check‑in desk or sales desk with your passport and flight details. Our agent will print out your ticket. Manage your United Airlines reservations. View a trip using your confirmation number or MileagePlus number United Airlines - Airline Tickets, Travel Deals and. Also, if you are a member of Miles&Smiles, once you have signed in to your account, you can find details of all your past and future flights in the my flights. Enter your information to look up a trip. You can search by booking reference or ticket number. All fields required. Find Your Trip By. original ticket to determine the eligibility and the unused value of the ticket) Airlines ticket credits by clicking the Add Ticket Credit option in. Receipts can be accessed through the manage reservation page up until 2 days after the last flight on that receipt. Receipts for past reservations or service. How can I find last-minute flight deals? Finding last-minute flights is easy on Google Flights. Select your departure and destination cities in the form on the.

Transfer Credit Card Balance To New Card

Credit card balance transfers allow you to move debt from an existing credit card account to a new card at a lower interest rate. Choose “Report lost card” from the quick links on the left hand side; Select “Cancel and transfer your balance and details to another card in your account” and. Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. In the TD app: · Go to your Credit Card Account Activity page and click on the "Manage" icon. · Click on your special balance transfer offer and follow the steps. Transfer your credit card balance and get 0% interest for up to 10 months with a 1% transfer fee† and a first. How do credit card balance transfers work? · Decide which credit card to use. If you already have credit cards, review your current cards for available balance. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. you can strategically use a balance transfer to reduce the cost of a credit card balance. In most cases, this will involve applying for a new. 14 Best balance transfer cards of September · + Show Summary · Wells Fargo Reflect® Card · Citi Double Cash® Card · Discover it® Chrome · Blue Cash. Credit card balance transfers allow you to move debt from an existing credit card account to a new card at a lower interest rate. Choose “Report lost card” from the quick links on the left hand side; Select “Cancel and transfer your balance and details to another card in your account” and. Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. In the TD app: · Go to your Credit Card Account Activity page and click on the "Manage" icon. · Click on your special balance transfer offer and follow the steps. Transfer your credit card balance and get 0% interest for up to 10 months with a 1% transfer fee† and a first. How do credit card balance transfers work? · Decide which credit card to use. If you already have credit cards, review your current cards for available balance. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. you can strategically use a balance transfer to reduce the cost of a credit card balance. In most cases, this will involve applying for a new. 14 Best balance transfer cards of September · + Show Summary · Wells Fargo Reflect® Card · Citi Double Cash® Card · Discover it® Chrome · Blue Cash.

A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form. Choose from your Chase cards to see if you have eligible balance transfer offers. Enter amount. Select an offer, then enter the amount and the credit card to. As the name suggests, a balance transfer allows you to transfer the outstanding balance owed to your current credit card issuer to another card at a lower. Your credit card account application allows you to request the transfer of balances from up to three (3) credit card accounts or other types of loans from. Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower interest rate. A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form. A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This. I am wondering should I open a 0% intro card and transfer the balance over to it? I've done some math and it seems to be the cheaper option and a no-brainer. A balance transfer is when you shift debt from one (or many) cards to another card. Typically, you would transfer to a credit card with a lower interest rate. Step 1: Check your current balance and interest rate · Step 2: Choose the right credit card for you · Step 3: Apply for a credit card · Step 4: Transfer the. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Balance Transfer Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months · $0. ; Chase Freedom Unlimited credit card · Earn a. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. A credit card balance transfer is a transfer of a balance from one credit card account to another. You may wish to transfer, for example, a balance from a high-. But if you move your debt to a balance transfer card that offers no interest for up to 20 months, you can save a large chunk of money and pay off your credit. It is possible to transfer money from a credit card to a debit card, but there are several things you need to take into account first. However, Balance Transfers are not subject to Cash Advance transaction fees. Please see your Disclosure Statement mailed to you with your Welcome Package for. A balance transfer can take anywhere from a few days to several weeks, depending on the credit card company, but they're typically done within five to seven. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate.

Personal Loan To Increase Credit Score

Best personal loan lenders for a credit score of or lower ; Best for people without a credit history · Upstart Personal Loans ; Best for flexible terms. The ScoreMore Loan SM is a great option that could help you raise your credit score up to 60 points 1 on average while also increasing your savings by $ 1. Credit-builder loans can be a helpful option if you are credit invisible or want to raise your credit scores. If you have the income for regular on-time. Paying your personal loan on time will eventually improve your credit score even if you've had past credit debts or unpaid loans. Loan Reprice Program. Members who make timely payments and maintain a good credit score may become eligible for an even lower rate on their BECU personal loan. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. Do loans affect my credit score? How any sort of loan affects your credit is ultimately down to the borrower and how well they manage it. So as long as you. Borrowing a personal loan can impact your credit score in a number of ways. But generally, taking out a personal loan and repaying it on time will have a more. A personal loan can positively affect your credit scores if you make consistent, on-time payments. A personal loan could also affect your credit mix and total. Best personal loan lenders for a credit score of or lower ; Best for people without a credit history · Upstart Personal Loans ; Best for flexible terms. The ScoreMore Loan SM is a great option that could help you raise your credit score up to 60 points 1 on average while also increasing your savings by $ 1. Credit-builder loans can be a helpful option if you are credit invisible or want to raise your credit scores. If you have the income for regular on-time. Paying your personal loan on time will eventually improve your credit score even if you've had past credit debts or unpaid loans. Loan Reprice Program. Members who make timely payments and maintain a good credit score may become eligible for an even lower rate on their BECU personal loan. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. Do loans affect my credit score? How any sort of loan affects your credit is ultimately down to the borrower and how well they manage it. So as long as you. Borrowing a personal loan can impact your credit score in a number of ways. But generally, taking out a personal loan and repaying it on time will have a more. A personal loan can positively affect your credit scores if you make consistent, on-time payments. A personal loan could also affect your credit mix and total.

When you have a poor credit score, it lowers your chances of qualifying for a personal loan. It also affects the interest rate you receive if a lender approves. Using a personal loan to consolidate high-interest credit card debt might even help you improve your credit score, by diversifying your credit mix, showing. Looking to build your credit? The Credit Builder Loan is the perfect start on your journey towards financial freedom by helping you to establish or restore a. Yes. As with most loans, your approval and interest rate depend, in part, on your credit score and history. Do I have to pay a fee to. Taking on a personal loan can help improve your credit mix. Your credit mix refers to the different types of credit accounts you have, including credit cards. The service is free, but it only impacts your FICO score for Experian. StellarFi is an alternative that helps you build credit for recurring payments, reporting. That's because your payment history—meaning whether you've paid your past credit card and other loan bills on time or not—is typically one of the most important. Many people are not aware that handling personal loans in a disciplined manner can boost your credit score. Let us find out how. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Personal loans can be a smart way to consolidate credit card debt or make home improvements. Find the best personal loan rate based on your credit score. 2. Pay Down Revolving Account Balances · Debt consolidation loan · Balance transfer credit card · Debt management plan · Debt repayment strategy, such as the debt. According to the credit bureau Experian, adding an installment loan to your “credit mix” can improve your credit score because it shows you can manage different. Checking your loan options, including your rates and terms, will not affect your credit score. Please note that once you make a selection and submit an. In short, taking a personal loan can actually help you improve 90% of the factors used by credit bureaus for calculating your credit score. New Credit and. The lower the ratio, the better it is for your credit score. When you take out a personal loan, you can improve your credit utilization ratio by having more. The simplest answer is better loan terms and easier approval. A good or excellent credit score will save most people hundreds of thousands of dollars over the. Minimum credit score applies to debt consolidation requests, minimum applies to cash out requests. Other conditions apply. Fixed rate APRs range from. Tips for boosting your credit to get a better loan · Pay your bills on time. Payment history is one of the most important factors in a credit score. · Ask for a. That's because your payment history—meaning whether you've paid your past credit card and other loan bills on time or not—is typically one of the most important.

Wingstop Franchise Startup Cost

When exploring Wingstop franchises, keep in mind that you can only choose a multi-store development with a minimum of three units. They also require previous. How much does a Chick-fil-A franchise cost? Depending on location, size of your store, the amount of inventory you carry at opening, the size of your retail. cost factors, opening a new Wingstop franchise can cost from $, up to $, After opening, you can expect to pay the usual range of ongoing fees. A $10, transfer fee per store will cover the cost of training and all remaining terms on the franchise agreements. No need to worry that you won't know what. Key requirements for our restaurant franchising opportunities: Multi-unit franchise opportunity operators are preferred; Should have a passion for brands and. In order to open WingStop Franchise you need to keep certain requirements in consideration. The franchisee should have some business experience and a business. To buy a franchise with Wingstop, you'll need to have at least liquid capital of $, $, They also offer financing via 3rd party as well as a. In addition to net sales and income numbers from existing stores, potential franchisees should consider their start-up costs and ongoing expenses when. The total Wingstop franchise cost varies between $, to $,, with an initial franchise fee of $30, Whether you are building a new space or. When exploring Wingstop franchises, keep in mind that you can only choose a multi-store development with a minimum of three units. They also require previous. How much does a Chick-fil-A franchise cost? Depending on location, size of your store, the amount of inventory you carry at opening, the size of your retail. cost factors, opening a new Wingstop franchise can cost from $, up to $, After opening, you can expect to pay the usual range of ongoing fees. A $10, transfer fee per store will cover the cost of training and all remaining terms on the franchise agreements. No need to worry that you won't know what. Key requirements for our restaurant franchising opportunities: Multi-unit franchise opportunity operators are preferred; Should have a passion for brands and. In order to open WingStop Franchise you need to keep certain requirements in consideration. The franchisee should have some business experience and a business. To buy a franchise with Wingstop, you'll need to have at least liquid capital of $, $, They also offer financing via 3rd party as well as a. In addition to net sales and income numbers from existing stores, potential franchisees should consider their start-up costs and ongoing expenses when. The total Wingstop franchise cost varies between $, to $,, with an initial franchise fee of $30, Whether you are building a new space or.

Wingstop Franchise Cost: Financial Requirements and Fees ; Fees/ Expenses, Financial Amount ; Liquid Capital, $, ; Net Worth, $1,, ; Total Investment. INVESTMENT REQUIREMENTS (Averages only. Actual amounts may vary due to franchise specifics - location, size, etc.) Minimum Investment: $, Startup Capital. From this data, we identified our list of top low-cost franchises with the highest franchisee start up costs are the lowest on our Top Food. Franchises list. THIS REQUIREMENT PLACES THE PERSONAL ASSETS. OF THE FRANCHISEES AND THEIR SPOUSES AT RISK. 4. THERE MAY BE OTHER RISKS CONCERNING THIS FRANCHISE. EFFECTIVE DATE. You can be a part of our success when you buy your very own Wingstop franchise! We have a plan to become a top 10 global restaurant brand and serve the. Start-Up Costs and Fees ; Wingstop Franchise · Slim Chickens Franchise ; Investment, $, - $,, $, - $1,, ; Franchise Fee, $30,, $15, The high end of the total investment required to open a Wingstop Restaurant franchise is ₱, New franchisees can expect to pay a ₱20, franchise fee for. Wingstop Franchise Cost v. Competition. When looking to buy a food franchise Fast Food Franchise Startup Costs: Is Cheaper Really Better? Breaking. The average WingStop location does $ million in sales. But start-up costs can be as high as $k. Still a pretty decent ration in my. Investment: Startup costs for a Wingstop franchise range between $,$, This cost includes the franchise fee, real estate, equipment, and. To qualify as a Wingstop franchisee, we require a minimum net worth of $1,,, of which $, must be liquid. There is also a 3 store. $25 initial set up cost/up to $50 per month. Intranet Maintenance and Development Fee, Up to $50 per month. Operations Manual(s) Training Materials Replacement. Related Food & Beverage Franchises · Min. Cash Required: $, · Net Worth Required: $1,, · Total Startup Investment: $, - $, · Franchising. you thought of just opening up your own store. to skip the line? Well, this is the cost breakdown. The average initial investment. for a Wingstop is $, Initial investment: $, – $, Net worth requirement: $ million. Liquid asset requirement: $, Franchise fee: $20, Development fee. Initial investments: $12, - $, Net-worth Requirement: ; Initial Franchise Fee: $3, Ongoing Royalty Fee: ; On-The-Job Training: 30 hours. Classroom. Initial investments: $, – $, · Net-worth Requirement: $1,, · Liquid Cash Requirement: $, · Development Fee – $10, · Franchise Fee –. Franchise Fees ; Min. Franchise Fee. $10, Veteran's Fee: $5, ; Royalty Fee. % Gross Sales ; Ad Fund Fee. % Gross Sales. The minimum cash you will need (without the bank) is $75, Do you meet this requirement? Yes No.

How Do I Change My Homeowners Insurance

You can switch your homeowner's insurance policy to a new provider at any time—but be sure to follow these steps to avoid gaps in coverage. Whether you are interested in purchasing, reviewing or replacing homeowners, renters, condominium or mobile home insurance, it is important to shop and compare. First, you should buy your new policy before canceling your current insurance. Then, you can request for your prior policy to be cancelled on or after your new. for an insurer to modify the value assigned to the property insured (change the limits of coverage) under a policy of homeowners" insurance increase? Manage and make payments for your homeowners insurance policy online. Update your contact information, pay bills, and request documents. Important! You must contact Assurant at to give authorization to accept the new insurance information. Contact your previous. Yes, to an extent. For the dwelling itself, your limit is calculated by the insurance provider and based on the Replacement Cost Estimate of your home. You can change your homeowners insurance carrier any time you like. The ideal time is when your policy is set to renew. Typically, homeowners insurance. 5 steps to changing homeowners insurance · Review your current coverage · Check out a few home insurance providers' rates · Buy your new policy · Tell your old. You can switch your homeowner's insurance policy to a new provider at any time—but be sure to follow these steps to avoid gaps in coverage. Whether you are interested in purchasing, reviewing or replacing homeowners, renters, condominium or mobile home insurance, it is important to shop and compare. First, you should buy your new policy before canceling your current insurance. Then, you can request for your prior policy to be cancelled on or after your new. for an insurer to modify the value assigned to the property insured (change the limits of coverage) under a policy of homeowners" insurance increase? Manage and make payments for your homeowners insurance policy online. Update your contact information, pay bills, and request documents. Important! You must contact Assurant at to give authorization to accept the new insurance information. Contact your previous. Yes, to an extent. For the dwelling itself, your limit is calculated by the insurance provider and based on the Replacement Cost Estimate of your home. You can change your homeowners insurance carrier any time you like. The ideal time is when your policy is set to renew. Typically, homeowners insurance. 5 steps to changing homeowners insurance · Review your current coverage · Check out a few home insurance providers' rates · Buy your new policy · Tell your old.

increase with actuarial evidence, the OIR is required to approve it. The company sent me a non-renewal notice. However, I have existing damage on my home. I. What Limits Should I Set on My Policy? The “dwelling” limit should be the amount it would cost to replace your home. This may have nothing to do with the. How much would I save if I increase my deductible? Does coverage include water damage or sewer backup? What is the difference between flood insurance and. If you want to change carriers, you contact the agent for a different carrier. If you actually make the change, your new agent will most likely. Steps to change homeowners insurance providers · 1. Review your current policy · 2. Determine your policy needs · 3. Research different providers and get quotes · 4. If your insurance score has improved since the previous year (maybe your credit is better or an old claim expired, etc) some companies can “. Start by contacting your insurance company. Learn more about insurance claims and repairing your property. Manage your account and pay online. Sign. Yes, you can change your home insurance after closing at any time. Closing on 1st home in November. How best to handle homeowners insurance/. Can the insurance company change my deductible without me requesting it? Yes How do I know if my homeowners insurance covers hail damage? Ask your friends, check the Yellow Pages or contact your state insurance department. (Phone numbers and Web sites are on the back page of this brochure.). My insurance jumped up from --> over the course of 3 years with no claims. Went to an insurance broker and got it down to $ I think. If you want to change carriers, you contact the agent for a different carrier. If you actually make the change, your new agent will most likely. The old insurance company will also officially notify them of the cancellation. Step 5: Leave the rest up to the companies. If you've switched to a homeowners. While you can change your homeowners insurance coverage at any time, it's important to note that doing so may also change your escrow (and, in turn, your. Manage and make payments for your homeowners insurance policy online. Update your contact information, pay bills, and request documents. Yes. You can. There are a few things to consider, but if you find a better deal on homeowners insurance, in most cases, you should switch your policy over. Changing My Homeowners' Insurance Policy Most homeowner insurance policies do not cover your home if it is used as a rental property. This is because your. How to Review and Update Your Homeowner's Insurance · Measure How Much Coverage You Need · Recheck the Deductible · Hammer Away at Your Premium · Clean Up Your Work. The new homeowner must purchase their own home insurance policy. Home insurance must be in the current owner's name. 5. Is my stuff still insured while its. If damaged or destroyed, insurance can help pay to repair or replace your home and your belongings. How Can I Protect My Home and Reduce My Insurance? Many.

Can You Put Mortgage Payment On Credit Card

Most home loan lenders will not accept mortgage repayments directly from a credit card. In general, lenders like to see loan repayments made from your everyday. As you may know, making extra payments on your mortgage does NOT lower your monthly payment. Additional payments to the principal just help to shorten the. Yes, you can pay your mortgage with a credit card. However, it can result in higher interest rates & it's important to note that most banks don't accept. Credit or debit cards are not accepted for mortgage payments. Frequently If you're struggling to make your mortgage payment, we can help. To get. Credit cards can be used via some third parties to pay for mortgage, but I personally wouldn't do it. Too risky. Mortgages typically have far lower interest rates than credit cards do. If you're struggling with significant credit card debt, using your mortgage to help pay. You can take a cash advance from your credit card, and then use the cash to make the mortgage payment. Doing this puts you in a debt spiral that. No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. The majority of mortgage lenders prohibit direct credit card payments to avoid incurring transaction fees. Plus, most lenders discourage the idea of paying one. Most home loan lenders will not accept mortgage repayments directly from a credit card. In general, lenders like to see loan repayments made from your everyday. As you may know, making extra payments on your mortgage does NOT lower your monthly payment. Additional payments to the principal just help to shorten the. Yes, you can pay your mortgage with a credit card. However, it can result in higher interest rates & it's important to note that most banks don't accept. Credit or debit cards are not accepted for mortgage payments. Frequently If you're struggling to make your mortgage payment, we can help. To get. Credit cards can be used via some third parties to pay for mortgage, but I personally wouldn't do it. Too risky. Mortgages typically have far lower interest rates than credit cards do. If you're struggling with significant credit card debt, using your mortgage to help pay. You can take a cash advance from your credit card, and then use the cash to make the mortgage payment. Doing this puts you in a debt spiral that. No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. The majority of mortgage lenders prohibit direct credit card payments to avoid incurring transaction fees. Plus, most lenders discourage the idea of paying one.

Paying off a loan with a credit card will depend on the lender and the type of loan. If your lender allows it and you are given enough of a credit limit. Bills that typically allow credit card payments include: In general, loans (including student loans and auto loans), mortgages and rent aren't payable with a. Section (c) requires loan servicers to credit a payment to a consumer's loan account as of the date it is received. However, this does not mean that. Mortgage lenders don't accept credit card payments directly. If you have a Mastercard or Discover card, you may be able to pay your mortgage through a payment. Third-party companies and alternative payment methods enable homeowners to use their credit cards to pay their monthly mortgage payments. Yes, you can pay your mortgage with a credit card. However, it can result in higher interest rates & many banks don't accept card payments. If the servicer made a mistake or charged you a fee you don't owe, correct it as soon as possible. But keep making your regular monthly mortgage payment. Don't. High-interest debt from credit cards or loans makes it hard to manage your finances. But if you're a homeowner, you can take advantage of your home's equity. Pay Mortgage With A Credit Card using the cloud-based platform to avoid missed payments. You can make secure and timely payments without worrying about a lack. Can I pay my mortgage with my credit card? While you're unable to make a mortgage payment using a credit card or debit card, you can set up automatic. Yes, you can pay a mortgage with a credit card. Although your local mortgage lender won't let you swipe your Mastercard for your monthly payment. It depends on the mortgage loan servicer and the credit card issuer. Some mortgage companies do accept some credit cards for payment and some. For instance, if you come into a lump sum amount of money or you get a raise, or your finances change at all, we could help you change your mortgage payments in. It's best to avoid making large purchases on credit during the mortgage process. A lender may not care if you use your credit card for smaller transactions. Mortgages, rent and car loans typically can't be paid with a credit card. You may need to pay a convenience fee if you pay some bills, like utility bills, with. It is possible to use your credit card to pay your mortgage if your card network, card issuer and mortgage lender all agree to it. Make a one time payment for today or pay later with a future dated or recurring monthly payment. You can automate your monthly mortgage payments and avoid. You cannot make a payment to Freedom Mortgage with a credit card. Where Can You Find the Amount of Your Mortgage Payment? You can find your payment amount by. If you use your rewards card for your regular monthly spending, you should only need to put one or two mortgage payments toward the bonus. So, you're going. So, quite often either your card issuer or your mortgage lender will say no to any request to pay your mortgage with your credit card, even if you have stellar.

How Does Credit Card Company Make Money

It's time to pass the Credit Card Competition Act so credit card companies will have to compete the same as small businesses. That would make networks. When you make a purchase with a debit card, you're using your own money, but when shopping with a credit card, the money is drawn from the credit card company. Additionally, credit card companies make money by charging high interest rates on balances that carry over month-to-month, and issuing late fees for payments. What will my credit card company do? Do not ignore letters and emails from You can do this by sharing a budget that shows how much money you: Have. Using a combination of interest rates and minimum monthly payments, a bank can make a large profit. Advertisement. But it seems a bit counterintuitive. If you. How Do Credit Card Issuing Companies Make Money? · Revenue Sources for a Card Issuer or an Issuing Bank: · Interchange Fees: Merchant discount. This type of credit card company makes money by charging you interest if you carry a balance. They might also make money by charging annual fees on some of. Annual fees and finance charges can significantly increase your credit costs. Annual fees are set by the card issuer and interest rates may vary by the prime. This is essentially an amount of money that the credit card company allows you to use to make purchases or pay bills. Your available credit is reduced as. It's time to pass the Credit Card Competition Act so credit card companies will have to compete the same as small businesses. That would make networks. When you make a purchase with a debit card, you're using your own money, but when shopping with a credit card, the money is drawn from the credit card company. Additionally, credit card companies make money by charging high interest rates on balances that carry over month-to-month, and issuing late fees for payments. What will my credit card company do? Do not ignore letters and emails from You can do this by sharing a budget that shows how much money you: Have. Using a combination of interest rates and minimum monthly payments, a bank can make a large profit. Advertisement. But it seems a bit counterintuitive. If you. How Do Credit Card Issuing Companies Make Money? · Revenue Sources for a Card Issuer or an Issuing Bank: · Interchange Fees: Merchant discount. This type of credit card company makes money by charging you interest if you carry a balance. They might also make money by charging annual fees on some of. Annual fees and finance charges can significantly increase your credit costs. Annual fees are set by the card issuer and interest rates may vary by the prime. This is essentially an amount of money that the credit card company allows you to use to make purchases or pay bills. Your available credit is reduced as.

When a customer pays with their credit card, the card issuer seldom processes the transaction to move the money from their bank into the merchant's bank. This. So no matter the business, every time someone uses a credit card, payment processors make money by managing that credit card payment. Does that mean it's the. A payment processor is a company that processes debit and credit transactions and provides the hardware that allows merchants to accept credit card payments. It. Here's the good news: you don't have to be a credit card expert to sell merchant processing solutions. All you have to do is show merchants and other. Credit card companies have 3 main sources of revenue, membership fees, transaction fees and interest on unpaid balances. If an emergency happens and you can't pay them off in full, always make the minimum payment. Missing a minimum payment will damage your credit score, whereas. When you make a credit card, you'll be able to generate revenue through interest charges and fees charged to consumers and merchants. 2. Increased Loyalty. Annual fees and finance charges can significantly increase your credit costs. Annual fees are set by the card issuer and interest rates may vary by the prime. Credit card companies' revenue is primarily derived from interest rates, fees, and charges. However, there are other ways that credit card companies make money. Credit card companies typically charge merchants a fee for each transaction processed. This fee is a percentage of the transaction amount, often ranging from. Issuer: The bank that provides banking or payment processing services and issues payment cards (such as credit, debit, cards or prepaid cards) as a member of. A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services, or withdraw cash, on credit. Credit card companies can help in both ie brand promotion and to generate sales. It is very effective and potent tool to reach new customers. Credit cards are another large revenue stream for banks, through interest and fees like those for late payments, going over your limit, and using your card in. Their main income is a discount fee which relies on the merchant. Primarily, payment companies generate revenue by charging them. The fee is calculated as a. Merchant banks allow merchants to accept deposits from credit and debit card payments. Payment processors are companies that process credit and debit card. Financial institutions charge interest on credit cards because that's one of the many ways they make money. Another reason interest is charged is to manage. A $1, transaction, therefore, could have fees ranging from $15 up to $ The overall impact depends on your margins. If your total profit on a given. Cardholders can spend up to their approved card limit, but they must make at least a minimum payment to the issuer each month by the due date. Credit card.

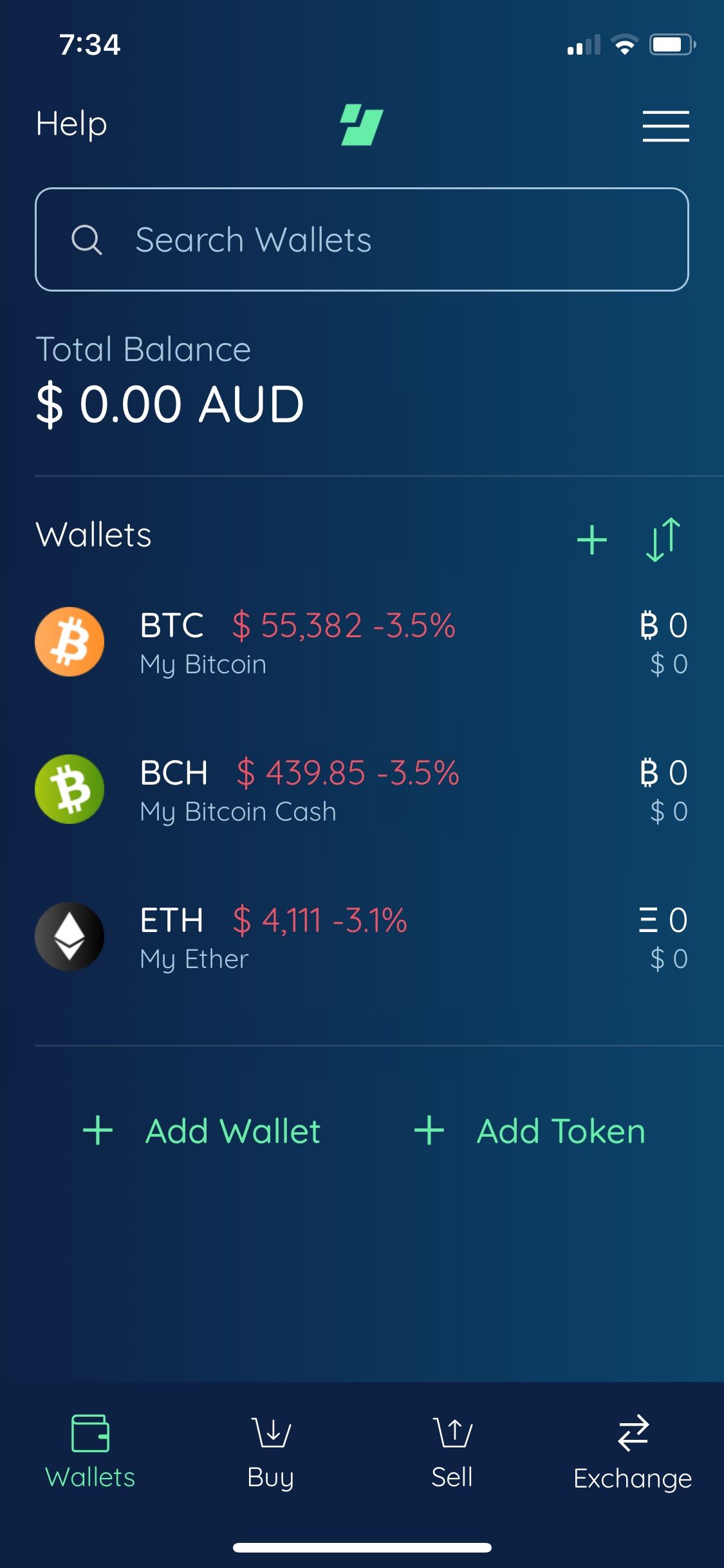

Best Crypto Wallet App Reddit

maximbregnev.ru - ColdCard is currently the safest and most recommended here. BitBox02 - another great little device, opt for the. NDAX has been a great exchange when buying and selling larger amounts of crypto however for LTC they have a flat fee of $5 Canadian, which when. I highly recommend OneKey, especially for someone just starting out in crypto. It's cost-effective and super secure. OneKey doesn't store your. Safe is great but might be too complicated for lots of folks. Every system has tradeoffs. If you haven't heard of Zengo (MPC wallet) - multi-. For wallets - Phantom or Solflare. You can't go wrong with either of them. As for exchanges, you have a few different options - I would say. Ledger and Trezor are the most widely used ones and they are good. Some alternatives: If you want Bitcoin only and max. security I'd consider. Think it depends on what you are looking for but I really like Muun and Phoenix for non custodial and cash app for purchasing bitcoin. I also. Once you do any purchase using INR to Crypto within the WazirX app, then your crypto withdrawals will be disabled. You cannot transfer even $1. BlueWallet is probably the most well featured bitcoin wallet for iOS. Upvote. maximbregnev.ru - ColdCard is currently the safest and most recommended here. BitBox02 - another great little device, opt for the. NDAX has been a great exchange when buying and selling larger amounts of crypto however for LTC they have a flat fee of $5 Canadian, which when. I highly recommend OneKey, especially for someone just starting out in crypto. It's cost-effective and super secure. OneKey doesn't store your. Safe is great but might be too complicated for lots of folks. Every system has tradeoffs. If you haven't heard of Zengo (MPC wallet) - multi-. For wallets - Phantom or Solflare. You can't go wrong with either of them. As for exchanges, you have a few different options - I would say. Ledger and Trezor are the most widely used ones and they are good. Some alternatives: If you want Bitcoin only and max. security I'd consider. Think it depends on what you are looking for but I really like Muun and Phoenix for non custodial and cash app for purchasing bitcoin. I also. Once you do any purchase using INR to Crypto within the WazirX app, then your crypto withdrawals will be disabled. You cannot transfer even $1. BlueWallet is probably the most well featured bitcoin wallet for iOS. Upvote.

maximbregnev.ru - Solid choice, Open Source and Non-Custodial, one of the oldest and most trusted Bitcoin Wallets. Lightning wallets to. If you have enough funds and would live to own a hardware wallet then you should go for Ledger or Trezor, those two are very good and secure. Why don't all web 3 applications just use eth instead of some new coin like Pixel which is created with the Ethereum chain? What is a wallet. Coinbase is probably your best option as far as regulated exchanges go. What makes you think they're manipulating prices? For a spending hot wallet right now the "best" option now I would choose Blockstream green because: It has a ton of features like RBF fee. Bluewallet, Electrum wallet, Blockstream Greenwallet, Trust wallet, Safepal wallet, Exodus wallet. All these wallets are safe as long as you. For shitcoins, use Trust, Exodus, Coinbase Wallet or something like that. They should show the same exact BTC amount as Blue Wallet. Btw, if you. maximbregnev.ru - Solid choice, Open Source and Non-Custodial, one of the oldest and most trusted Bitcoin Wallets. I prefer the desktop. My friend had that same question and, after doing some research on this sub, I came to the conclusion that Blue Wallet was the best and most. On Windows, use Sparrow Wallet. For Android there are quite a few good products. You can try BlueWallet for example. I'd go with the BlueWallet. It has a simple interface yet has all the necessary features. It is a great fit for beginners. Metamask is probably the best, has a good user interface, has been around for long and lots of crypto folks actually use it. On a personal note. Best Bitcoin wallets for iOS is Jaxx Liberty, which is extremely popular as a multi-currency crypto wallet. Upvote. For most people with common sense, any popular hardware wallet, Trezor, Ledger,safepal, etc. Pick one that is easy to use and with a nice. What's the best mobile wallet app? · Exodus. This is currently my main wallet. · Trust Wallet. As I mentioned, I still use this one actively as. indeed. I recommend you Sparrow as a desktop wallet. it has nice interface and good utxo management. I think it is the new favourite of most. Coinbase Wallet - The Coinbase Wallet is a web wallet that allows you to securely store your cryptocurrency holdings. It supports over I personally use exodus and metamask for my hot wallets. I keep very little on them as I have my cold wallet but exodus has a great mobile app. I second Electrum. Been using it since I started using wallets; used it as desktop hot until I got hardware, then as the interface to use. What are some good crypto wallet cores for Android? ; maximbregnev.ru - Top Security Features, Open Source and Non-Custodial.

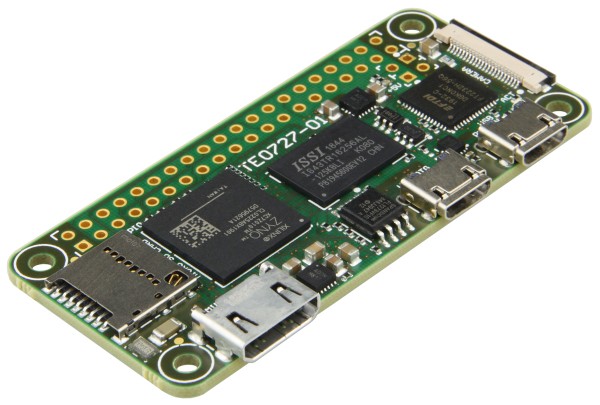

Fpga For Raspberry Pi

With its Raspberry Pi form factor, the ZynqBerry can easily take advantage of all the peripherals and accessories available for the Pi. In this repository, applications of Raspberry pi (RPi) and FPGA interface are under progress. RPi acts as a web server which taken user inputs and displays. List of FPGA dev boards for Raspberry Pi HATs ; PYNQ-Z2, Zynq, SoC ; PYNQ-ZU, Zynq UltraScale+, MPSoC ; ZynqBerry , Zynq, SoC ; ZynqBerry , Zynq-. Findings: The use of Raspberry Pi makes the controllability and observability of FPGA pins easy and the inputs, outputs of FPGA can be remotely controlled via. Expand your Raspberry Pi capabilities with this add-on board from Bugblat featuring the MachXO2 FPGA. Version 2 now available. The MTPi emulates the classic Roland MT32 sound module from the 80s on MiSTer. It's a Raspberry Pi based device that can run as a standard MT In what application scenarios can an FPGA development board (such as BASYS 3) be better than single board computer (like Raspberry Pi)? maximbregnev.ru: Taidacent HEX ZYNQ FPGA Development Board Raspberry Pi Edition ZEDBOARD XILINX FPGA Kit: Electronics. No, Raspberry Pi is not an FPGA. Both have nothing in common. There is just no comparison between them. Raspberry Pi is just a mini version. With its Raspberry Pi form factor, the ZynqBerry can easily take advantage of all the peripherals and accessories available for the Pi. In this repository, applications of Raspberry pi (RPi) and FPGA interface are under progress. RPi acts as a web server which taken user inputs and displays. List of FPGA dev boards for Raspberry Pi HATs ; PYNQ-Z2, Zynq, SoC ; PYNQ-ZU, Zynq UltraScale+, MPSoC ; ZynqBerry , Zynq, SoC ; ZynqBerry , Zynq-. Findings: The use of Raspberry Pi makes the controllability and observability of FPGA pins easy and the inputs, outputs of FPGA can be remotely controlled via. Expand your Raspberry Pi capabilities with this add-on board from Bugblat featuring the MachXO2 FPGA. Version 2 now available. The MTPi emulates the classic Roland MT32 sound module from the 80s on MiSTer. It's a Raspberry Pi based device that can run as a standard MT In what application scenarios can an FPGA development board (such as BASYS 3) be better than single board computer (like Raspberry Pi)? maximbregnev.ru: Taidacent HEX ZYNQ FPGA Development Board Raspberry Pi Edition ZEDBOARD XILINX FPGA Kit: Electronics. No, Raspberry Pi is not an FPGA. Both have nothing in common. There is just no comparison between them. Raspberry Pi is just a mini version.

Stick an FPGA on the Raspberry Pi from XESS on Tindie. Raspberry PI RP processor providing dual-core Arm M0+ cores running at MHz. SDRAM - 64 MBit; 4 Pmod - Three for FPGA, one for RPi - Ability to. FPGA Mezzanine Card for connecting up to 4x Raspberry Pi compatible cameras to FPGA development boards. The good news is you can program FPGA from Lattice Inc using free and open source tool that compile Verilog and download to FPGA. A very simple FPGA development board that plugs into a Raspberry Pi, so you have a backup hard-core CPU that can control networking, etc. List of FPGA dev boards for Raspberry Pi HATs ; PYNQ-Z2, Zynq, SoC ; PYNQ-ZU, Zynq UltraScale+, MPSoC ; ZynqBerry , Zynq, SoC ; ZynqBerry , Zynq-. LOGI PI FPGA DEVELOPMENT BOARD FOR THE RASPBERRY PI. FPGA MEETS CPU – USE YOUR IMAGINATION. The LOGI Pi is an FPGA development platform that has been. The interface between the Pi 4 and FPGA can be anything at all, of course I will just make the FPGA design accordingly. Should I use gpio bits in some parallel. Find many great new & used options and get the best deals for Raspberry PI MCU/MPU/DSC/DSP/FPGA Kit - BUNDLE XBMC ENET HDMI KBOARD MOUSE at the best online. icoBOARD is a FPGA based IO board for RaspberryPi. I was wondering if there is a possibility of using a FPGA to do this part of the project and connecting the FPGA and the Raspberry Pi together. The MESA 7C81 is FPGA motherboard host for a Raspberry Pi CPU. The 7C81 connects to the RPI's GPIO interface and uses SPI for FPGA communication. Raspberry Pi · Boards / Kits · Raspberry Pi 5 · Raspberry Pi 4 · Raspberry Pi 3 · Raspberry Pi · Raspberry Pi Zero 2 W · Raspberry Pi Zero · Raspberry Pi. The FPGA can be programmed with gateware built using open-source FPGA development tools. We recommend using either a Raspberry Pi, Raspberry Pi Pico. Raspberry PI RP processor providing dual-core Arm M0+ cores running at MHz. SDRAM - 64 MBit; 4 Pmod - Three for FPGA, one for RPi - Ability to. Cool board, I have programmed those UP5K with the Icestorm FPGA tools running on this Pi Raspberry Pi for industry · Thin clients · Raspberry Pi in space. Mesa Electronics 7C81 Raspberry Pi FPGA Board The Mesa 7C81 is FPGA motherboard host for a Raspberry Pi CPU. The 7C81 connects to the Raspberry Pi's GPIO. Install standoffs onto Raspberry. Pi (stand-offs are only fitted for model A/B) and Plug the LOGI Pi into the 26 Pin Header of Raspberry Pi. 2. Model B+ version. What is the pif board? A pif board, which plugs into a Raspberry Pi, carries a non-volatile Lattice Semiconductor MachXO2 FPGA. To program the FPGA, you start. The MESA 7C81 is FPGA motherboard host for a Raspberry Pi CPU. The 7C81 connects to the RPI's GPIO interface and uses SPI for FPGA communication.

How Much Does It Cost To Chimney Sweep

The average hourly rate is $75, while flat rates typically average out at around $ Getting on a regular maintenance routine with your chimney sweep as well. Depends - if he is coming from within 5 miles of your house - expect to pay X · If he is coming from 50 miles expect to pay 50 X · If it is a. Chimney Cleaning ; Single Flue. $ ; Double Flue. $ ; Each additional Flue. $ per each additional flue ; Rotary Cleanings. Add $ to sweep price per flue. How much do Chimney Sweep jobs pay per hour? The average hourly pay for a Chimney Sweep job in the US is $ Hourly salary range is $ to $ A chimney sweep service will typically cost between $99 and $ Depending on the services offered, and the place you live this may change. We have covered. Visual inspection of the damper and the cap is a part of this service. Please review our Chimney Cleaning Options below the price and choose the one that is. The cost of a chimney sweep typically ranges from $ to $, depending on the type of chimney, the level of buildup, and the complexity of the cleaning. Total chimney sweep costs The national average cost for chimney sweeping is $90– per chimney. But your overall chimney-cleaning costs will depend on both. For $90 to $, a professional chimney sweep should thoroughly clean your fireplace and chimney and check for defects. Many sweeps lower video cameras and. The average hourly rate is $75, while flat rates typically average out at around $ Getting on a regular maintenance routine with your chimney sweep as well. Depends - if he is coming from within 5 miles of your house - expect to pay X · If he is coming from 50 miles expect to pay 50 X · If it is a. Chimney Cleaning ; Single Flue. $ ; Double Flue. $ ; Each additional Flue. $ per each additional flue ; Rotary Cleanings. Add $ to sweep price per flue. How much do Chimney Sweep jobs pay per hour? The average hourly pay for a Chimney Sweep job in the US is $ Hourly salary range is $ to $ A chimney sweep service will typically cost between $99 and $ Depending on the services offered, and the place you live this may change. We have covered. Visual inspection of the damper and the cap is a part of this service. Please review our Chimney Cleaning Options below the price and choose the one that is. The cost of a chimney sweep typically ranges from $ to $, depending on the type of chimney, the level of buildup, and the complexity of the cleaning. Total chimney sweep costs The national average cost for chimney sweeping is $90– per chimney. But your overall chimney-cleaning costs will depend on both. For $90 to $, a professional chimney sweep should thoroughly clean your fireplace and chimney and check for defects. Many sweeps lower video cameras and.

Special pricing: $ — don't put it off any longer! · Clean your chimney for a safer home. · Affordable prices · A+ rating with the BBB · Award-winning local. Cleaning an average fireplace is estimated to cost around $ to $ A freestanding wood burning stove that has liners can go around $ to $ Wood. Although the average cost of chimney cleaning around the nation is about $, chimney cleaning prices can range from as low as $ to as high as $ If you are on a tight budget, you can clean your chimney for $20 to $ That includes all the materials needed. However, DIY chimney cleaning in Pittsburgh is. The National Fire Protection Association recommends that chimneys, fireplaces, and vents be inspected annually by a qualified professional and swept as. What's the average cost for chimney cleaning/inspection and any recommendations? · chimcare: booked until feb, $ for first, $ for second. RUTLAND Chimney Sweep Rectangular Wire Cleaning Brush is designed with the DIY homeowner in mind. This chimney brush can withstand a vigorous cleaning and. How much a chimney sweep will cost is a bit of a loaded question and the answer is sort of relative. We'd say it really depends on what constitutes. repair, chimney repair, chimney inspection, chimney liner installation and much more. price to clean your chimney or to perform a chimney inspection. The. Choosing DeepBreath Duct Cleaning for your Chimney Cleaning will cost you only $ for chimney sweep and a level 1 inpection. We believe in delivering our. The national average cost of chimney cleaning is between $ and $ Most people pay around $ for a level 2 inspection and cleaning of a wood stove. How We Get This Data Homeowners use HomeAdvisor to find pros for home projects. •. •. When their projects are done, they fill out a short cost survey. •. •. If you do, it can cost anywhere from $ - $ for a check-up and a basic cleaning, otherwise, without regular maintenance it will cost you between $ to. clean chimney, along with per unit costs and material requirements. See professionally prepared estimates for chimney cleaning work. The Homewyse chimney. A basic sweep and inspection runs around $ to $ But it could be more if your roof is very steep or hard to get to. You may also have to pay for. The national average cost of chimney cleaning is between $ and $ Most people pay around $ for a level 2 inspection and cleaning of a wood stove. How much does it cost to get your chimney swept? The cost of a traditional chimney sweep is $ at Wisconsin Chimney Technicians. This price includes a scan. Chimney sweeps are part of the required maintenance for any homeowner with a fireplace. Paying for a chimney sweep at least once a year is a necessity. After. clean and performing in tip top shape, free of fire hazards and soot! Base price: $ Additional Storey add $ Out of town add $ per hour of travel. Inspections are billed at a flat rate of $ If one of our inspectors discovers any issues or damage in your chimney, we will evaluate the cost of repair and.