maximbregnev.ru

Overview

Bitcoins The Future Of Money Answer Key

The short answer is that cryptocurrency is not a form of money. To Richards, Tony (), 'Future of Payments: Cryptocurrencies, Stablecoins or Central Bank. However, that looks unlikely today since international views of crypto range from, "Bitcoin is an official currency," in El Salvador and the Central African. Bitcoin (BTC) is a cryptocurrency (a virtual currency) designed to act as money and a form of payment outside the control of any one person, group, or entity. Buy Bitcoin, Ethereum, and other cryptocurrencies on a platform trusted by millions. The dizzying rise of bitcoin and other cryptocurrencies has created new challenges for governments and central banks. What's driving this increased interest in a form of currency invented in ? The answer comes from former Federal Reserve chairman Ben Bernanke, who once. The short answer is that cryptocurrency is not a form of money. To Richards, Tony (), 'Future of Payments: Cryptocurrencies, Stablecoins or Central Bank. The key to building a brighter future is cooperation—between the private and public sectors domestically and national authorities and organizations. Your opinion on bitcoin becoming true transactional money in future? Scarcity is key to store of value and altcoins are the antithesis. The short answer is that cryptocurrency is not a form of money. To Richards, Tony (), 'Future of Payments: Cryptocurrencies, Stablecoins or Central Bank. However, that looks unlikely today since international views of crypto range from, "Bitcoin is an official currency," in El Salvador and the Central African. Bitcoin (BTC) is a cryptocurrency (a virtual currency) designed to act as money and a form of payment outside the control of any one person, group, or entity. Buy Bitcoin, Ethereum, and other cryptocurrencies on a platform trusted by millions. The dizzying rise of bitcoin and other cryptocurrencies has created new challenges for governments and central banks. What's driving this increased interest in a form of currency invented in ? The answer comes from former Federal Reserve chairman Ben Bernanke, who once. The short answer is that cryptocurrency is not a form of money. To Richards, Tony (), 'Future of Payments: Cryptocurrencies, Stablecoins or Central Bank. The key to building a brighter future is cooperation—between the private and public sectors domestically and national authorities and organizations. Your opinion on bitcoin becoming true transactional money in future? Scarcity is key to store of value and altcoins are the antithesis.

Bitcoin legal tender in El Salvador can strongly influence the future of such decentralized currency, demonstrating how it is possible to use Bitcoin as a. to national currencies, the “money of the future”. Bjerg (, p) and quick answer: Money is debt. Let us digress. First, let us establish a. Key ideas in The Promise of Bitcoin · Introduction · 1. Money is a good system for commerce, but it isn't perfect. · 2. Governments and banks regularly mismanage. future dies, the disappointment will probably collapse the whole thing. Where Bitcoin differs from money is that government-issued money can. key factors that may affect Bitcoin's ability to become the currency of the future: Bitcoin replace the money in the future? ·. Short answer. Bitcoin (BTC) is a cryptocurrency (a virtual currency) designed to act as money and a form of payment outside the control of any one person, group, or entity. In short, while Bitcoin is a virtual currency, it lacks some key characteristics that could render it more useful. Is Bitcoin a Financial Investment? The. to national currencies, the “money of the future”. Bjerg (, p) and quick answer: Money is debt. Let us digress. First, let us establish a. Digital currency could shape all future commerce. Find out about how Bitcoin is paving the way for virtual money. As decentralised, math-based virtual currencies—particularly Bitcoin2—have garnered increasing attention, two popular narratives have emerged: (1) virtual. The advocates of Cryptocurrency believe that Bitcoin can replace the future money system, while a large number of critics believe otherwise. Bitcoin (abbreviation: BTC; sign: ₿) is the first decentralized cryptocurrency. Nodes in the peer-to-peer bitcoin network verify transactions through. Bitcoin: And the Future of Money. Triumph Books. ISBN "Bitcoin: The Cryptoanarchists' Answer to Cash". IEEE Spectrum. Archived from. Bitcoin: And the Future of Money. Triumph Books. ISBN "Bitcoin: The Cryptoanarchists' Answer to Cash". IEEE Spectrum. Archived from. Will cryptocurrency be the future of money? Are I think what you are really getting at with your question is why does bitcoin have any value at all? Maybe, with time and the refinement of the different models in the future, they could end up replacing the traditional digital currencies like Bitcoin or Ripple. Bitcoin is a cryptocurrency, a form of electronic money. It is a decentralized digital currency without is independent of banks. #Bitcoin, Inflation, and the Future of Money with. @LexFridman. has ~10 If #bitcoin isn't the answer, you're asking the wrong question. Image. LaDoger. This paper focuses on economic aspects of Bitcoin, being an attempt to answer the question if Bitcoin can be considered money in the light of economic theories. A person could simply memorise their private key and need nothing else to retrieve or spend their virtual cash, a concept which is known as a “brain wallet”. A.

What Does Udemy Mean

Udemy Business is Udemy's B2B (business to business) learning solution. The Udemy Business program empowers organizations to address their biggest workforce. Meaning and Origin. What does the name Udemy mean? Keep reading to find the user submitted meanings, dictionary definitions, and more. U is for unite, you. Udemy is an online learning platform that offers both paid and free courses to students around the world. Further than that, it's not essential for Udemy instructors to have any formal training in their course category. However, this doesn't mean that Udemy is. At Udemy, we're on a mission to transform lives through learning. Through our intelligent skills platform and a global community of instructors. Udemy is an online learning platform (a marketplace to sell and buy courses online) where an educator makes money by selling his courses and a. Udemy is an online course marketplace that focuses on having a large portfolio of different courses. Hosting courses through Udemy means you don't have to worry. Udemy | followers on LinkedIn. Where possibilities begin. | Our mission is to transform lives through learning. However, it doesn't mean that Udemy is the right educational platform to enhance your knowledge and skills. Is Udemy's content exactly what you're looking for? Udemy Business is Udemy's B2B (business to business) learning solution. The Udemy Business program empowers organizations to address their biggest workforce. Meaning and Origin. What does the name Udemy mean? Keep reading to find the user submitted meanings, dictionary definitions, and more. U is for unite, you. Udemy is an online learning platform that offers both paid and free courses to students around the world. Further than that, it's not essential for Udemy instructors to have any formal training in their course category. However, this doesn't mean that Udemy is. At Udemy, we're on a mission to transform lives through learning. Through our intelligent skills platform and a global community of instructors. Udemy is an online learning platform (a marketplace to sell and buy courses online) where an educator makes money by selling his courses and a. Udemy is an online course marketplace that focuses on having a large portfolio of different courses. Hosting courses through Udemy means you don't have to worry. Udemy | followers on LinkedIn. Where possibilities begin. | Our mission is to transform lives through learning. However, it doesn't mean that Udemy is the right educational platform to enhance your knowledge and skills. Is Udemy's content exactly what you're looking for?

Udemy | followers on LinkedIn. Where possibilities begin. | Our mission is to transform lives through learning. If you're eligible for a free trial, and see Try Personal Plan for free under Preview this course, this means the course is included. Can I request to have a. Udemy is the biggest online learning platform with a course offering of more than ,+ courses covering a variety of categories like Development, Business. What is Udemy? What do Udemy courses include? Where can I access Udemy Our marketplace model means we do not own the copyright to the content of. UDEMY means University of Distance Education Effective Mostly Yourself. LikeReply3 years ago. One minute of audio can mean minutes of editing. Know your Is Teaching On Udemy A Good Way To Create A Passive Income? Dave. A good README will allow recruiters to gain some insight to your skill set. And it means anyone interested in your code knows what to do after. Udemy Business offers a subscription package of select Udemy courses to customers, along with administrative features and other services. Udemy courses have helped millions across the world gain new skills in their own time and space, and its popularity means it is still widely recognised as a. It just means that not every course on Udemy is included in the Udemy Subscription. The courses that are part of the subscription are the. Udemy, Inc. is an education technology company that provides an online learning and teaching platform. It was founded in May by Eren Bali, Gagan Biyani. Founded in , Udemy is an online learning platform—the same genre as platforms like edX, Coursera, Udacity, and Khan Academy—but with a twist. Most online. What is Udemy? · So Udemy is a very huge and popular platform for learning purposes. · where the teachers upload their pre-build courses on. Udemy is an online course marketplace, not a learning management system. Udemy course categories include: Development, Business, Finance & Accounting, IT &. The Udemy Instructor Partner Program is an official program for Udemy Business instructors to partner more closely with Udemy and other participating. How do I create a course on Udemy? How do I update my instructor account or If no data exists for a topic you're searching for, it likely means. Companies subscribe to the service, which serves as a library of learning for their employees, essentially paying for employees' Udemy courses. This is one. Udemy Business is a next-gen learning solution that transforms the workplace learning experience through a consumer-first on-demand learning solution. Founded in , Udemy is an online learning platform—the same genre as platforms like edX, Coursera, Udacity, and Khan Academy—but with a twist. Most online. Udemy is an online learning platform that offers anyone a chance to learn and make a change for the better. Here's our full review with all the Pros & Cons.

Best Paid Banking Jobs

The top-paying finance job on our list is Chief compliance officer. These executives oversee all compliance-related duties and departments. Learn about careers at U.S. Bank and find a career that is challenging, satisfying and meaningful. Search current. The highest paying jobs in retail banking usually belong to loan officers and major corporate executives, such as the chief financial officer (CFO) and chief. You're tenacious and driven, so the last place you want to work is some boring bank. Same. Learn about careers at Capital One and view jobs here. Highest Paying Bank Jobs in the Finance Sector · Investment Banker · Private Equity Associate · Hedge Fund Manager · Chief Operating Officer · Risk Management. 9 Best High-paying Bank Jobs · 1. Financial Manager · 2. Investment Banker · 3. Financial Analyst · 4. Financial Examiner · 5. Credit Analyst · 6. Auditor · 7. Take a look at some of these best-paying bank jobs in major banks to help you decide if this is the right career path. Top 10 Highest Paying Finance Jobs (Inc Salaries) · 1. Investment Banker · 2. Financial Analyst · 3. Personal Finance Advisor · 4. Financial Manager · 5. Below are some of the highest-paying jobs at banks, from entry-level positions to managerial roles. The top-paying finance job on our list is Chief compliance officer. These executives oversee all compliance-related duties and departments. Learn about careers at U.S. Bank and find a career that is challenging, satisfying and meaningful. Search current. The highest paying jobs in retail banking usually belong to loan officers and major corporate executives, such as the chief financial officer (CFO) and chief. You're tenacious and driven, so the last place you want to work is some boring bank. Same. Learn about careers at Capital One and view jobs here. Highest Paying Bank Jobs in the Finance Sector · Investment Banker · Private Equity Associate · Hedge Fund Manager · Chief Operating Officer · Risk Management. 9 Best High-paying Bank Jobs · 1. Financial Manager · 2. Investment Banker · 3. Financial Analyst · 4. Financial Examiner · 5. Credit Analyst · 6. Auditor · 7. Take a look at some of these best-paying bank jobs in major banks to help you decide if this is the right career path. Top 10 Highest Paying Finance Jobs (Inc Salaries) · 1. Investment Banker · 2. Financial Analyst · 3. Personal Finance Advisor · 4. Financial Manager · 5. Below are some of the highest-paying jobs at banks, from entry-level positions to managerial roles.

What are Top 10 Highest Paying Cities for Banking Jobs in California. We've identified 10 cities where the typical salary for a Banking job is above the average. Investment Banking Firms Ranked by Pay · #10 Morgan Stanley - $, · #9 JP Morgan - $, · #8 Goldman Sachs - $, · #7 Citi - $, · #6 Bank of. Whatever is going on in your life, good or bad, they have your back.” — Suzanne Hurlburt, Head Teller, Morrisville, Vermont —. Employee Benefits & Perks. We. Highest Paying Bank Jobs (September ) Earn up to $k/yr as a Proprietary Trader, Commercial Banker, Options Trader or Energy Trader. Competitive salaries. Bank jobs generally come with good compensation. With a banking job, you can be sure of a steady source of income with high salaries. Quant is by far highest paying out of undergrad but it's impossible to get as a business student. As a business student, MF PE would be by far the highest. One of the ways we reward our team for their contributions is by offering comprehensive, high-quality benefits at a reasonable cost. These benefits are designed. Best Paying Jobs in Major Banks ($60K to $K) · 5. Bank Manager · 6. Compliance Manager · 7. Auditor · 8. Financial Analyst · 9. Loan Officer · Investment. Top 9 Highest Paying Bank Jobs · A career in banking can be challenging, interesting and, in many cases, lucrative. Here are some of the best-paying options. pay, and account questions. Estimated: $K - $K a year. I want to receive the latest job alert for banking in chicago, il. Sign In or Sign Up to Create. These jobs can offer above-average pay to start and go up from there. Here's an overview of high-paying finance jobs and some of the skills they may require. Investment banking is among the highest paying finance jobs in India, where candidates with significant experience can earn a total remuneration. Some of the only individuals in a bank that are likely to making more than the CEO, are the Global Head of Capital Markets and the Global Head of Investment. And, we'll train you to bring out your absolute best. You can even pick Paid holidays and vacations. Tuition assistance to further your education. Finance sector jobs pay higher than the median salary, even at entry-level positions. · Popular entry-level jobs in finance include analysts, tax associates. Find high paying available jobs at U.S. maximbregnev.ru information on U.S. Bank compensation and careers, use Ladders $K + Club. Investment Banking Managing Director Salary + Bonus: Base salaries are in the mid-six-figure range, with total compensation in the high six figures to low seven. Central Bank was included on the list of “Best Places to Work in Kentucky Paid Vacation & Holidays as well as Vacation Purchase Plan. Sick. Turns out, the median salary for the highest 10% of bankers in America is $97, New York is the best state for jobs for bankers, and Montana is the worst. Here you will get plenty of options to get a nice paying job and know about the top Highest-Paying Jobs in Finance Degree.

Affordability Check

Our calculator estimates what you can afford and what you could get prequalified for. Why? Affordability tells you how ready your budget is to be a homeowner. Use our affordability calculator to find cheap houses for sale within your budget. Start planning your purchase today! Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use our home affordability calculator to determine how much home you can afford based on your current financial situation. 5 Tips That Will Help You Pass An Affordability Check ; 1. Rein In Your Spending 2. Make Sure You're Registered To Vote 3. Pay All Your Bills On Time 4. AFFORDABILITY CALCULATOR. Calculate your monthly payments. Your actual rate, payment, and costs could be higher. Get an Official Loan Estimate before choosing a. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. How much rent can you really afford? This rent affordability calculator from Zillow uses your specific financial situation to help you decide. Our calculator estimates what you can afford and what you could get prequalified for. Why? Affordability tells you how ready your budget is to be a homeowner. Use our affordability calculator to find cheap houses for sale within your budget. Start planning your purchase today! Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use our home affordability calculator to determine how much home you can afford based on your current financial situation. 5 Tips That Will Help You Pass An Affordability Check ; 1. Rein In Your Spending 2. Make Sure You're Registered To Vote 3. Pay All Your Bills On Time 4. AFFORDABILITY CALCULATOR. Calculate your monthly payments. Your actual rate, payment, and costs could be higher. Get an Official Loan Estimate before choosing a. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. How much rent can you really afford? This rent affordability calculator from Zillow uses your specific financial situation to help you decide.

Minimise friction for players with affordability checks that run in the background in real-time. Multi-bureau icon. One-stop shop. GBG Affordability. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. Financial risk checks, formerly known as affordability checks in the UK, were essentially designed to protect players from gambling online with money they. Use the Chemung Canal Trust Company loan affordability calculator to plan your financial future. This form is only for active BRHP voucher holders. The turnaround time is two business days. Participants are permitted up to 3 affordability checks per day. Use the Employer Health Plan Affordability Calculator to determine whether employer-sponsored coverage of your family is affordable. If it's not, you may be. Need to figure out how much you have to offer for your ICHRA to be affordable? Please complete the inputs below to get instant affordability results for an. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Our mortgage affordability calculator makes it simple and fast to determine how much home you can afford based on relevant lending guidelines. Affordability Calculator. Can I afford this apartment with my voucher? This Always check these calculations with your Leasing Officer before proceeding. Use this calculator to estimate how much house you can afford with your budget Calculate affordability by. Income, Payment. Annual gross income? Must be. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. Loan Affordability Calculator. Calculators. Do you ever think to yourself, "I wish my bank could "? Well we can, and we're ready to help you! Most players in the UK will need to complete affordability checks, and the request to upload your documents will appear when you attempt to deposit. To know how much house you can afford, an affordability calculator can help. Getting pre-approved for a loan can help you find out how much you're qualified to. The Affordability Test helps our Optigo® lenders determine the percentage of a property's units that meet FHFA's mission-driven requirementspdf. This calculator can help you figure out your home price range. Fill in the fields below to calculate how much home you can afford. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Fifth Third Bank's Mortgage Affordability Calculator helps estimate how much home you can afford and which mortgage payments will work for your budget.

Best Approval Odds For Credit Card

/creditcard_452353217-ae223b6174b144cbbe587b7e8828e43c.jpg)

The first step is to check your credit score. Learn about the status of your credit to determine the best credit cards to apply for. You're more likely to. See If You Prequalify - No Impact to Credit Score. Pay **With credit approval for qualifying purchases made on The Home Depot Consumer Credit Card. Why it's one of the easiest credit cards to get: The First Progress Platinum Elite Mastercard® Secured Credit Card has some of the lowest approval requirements. What Does It Mean to Prequalify? · Answer 3 quick questions. · Pull your info without affecting your credit score. · See which card is best for you. Get pre-approved for a Capital One credit card with no impact on your credit score. Find out if you're pre-approved in as few as 60 seconds. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. In conclusion. There are several ways to help increase your odds of being approved for a Chase credit card. Improving your credit health is a big one. Enroll. Bottom Line Up Front · Most lenders set minimum income and credit score requirements for credit card approval, depending on the card. · Your length of employment. Knowing your credit score and number of inquiries is at best 20% of the relevant information that goes into a lending decision so the. The first step is to check your credit score. Learn about the status of your credit to determine the best credit cards to apply for. You're more likely to. See If You Prequalify - No Impact to Credit Score. Pay **With credit approval for qualifying purchases made on The Home Depot Consumer Credit Card. Why it's one of the easiest credit cards to get: The First Progress Platinum Elite Mastercard® Secured Credit Card has some of the lowest approval requirements. What Does It Mean to Prequalify? · Answer 3 quick questions. · Pull your info without affecting your credit score. · See which card is best for you. Get pre-approved for a Capital One credit card with no impact on your credit score. Find out if you're pre-approved in as few as 60 seconds. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. In conclusion. There are several ways to help increase your odds of being approved for a Chase credit card. Improving your credit health is a big one. Enroll. Bottom Line Up Front · Most lenders set minimum income and credit score requirements for credit card approval, depending on the card. · Your length of employment. Knowing your credit score and number of inquiries is at best 20% of the relevant information that goes into a lending decision so the.

Find the best credit card by American Express for your needs If you apply, get approved, and then choose to accept a Card, your credit score may be impacted. Capital One Platinum Mastercard: The Capital One Platinum Mastercard is geared toward people with fair credit who are interested in improving their credit. The First Progress Platinum Select Mastercard® Secured Credit Card has no minimum credit score or credit check requirement for approval. It has a fair interest. Capital One Quicksilver Secured Cash Rewards Credit Card: Best first secured credit card. Petal® 2 “Cash Back, No Fees” Visa® Credit Card *: Best first credit. When you get your results, our approval odds tool calculates which cards you're most likely to be approved for based on your credit profile and other factors. The NEW Huntington® Secured Credit Card is the credit-building, cash back-earning card with resources and education to help jumpstart your credit score. ¹Offer subject to credit approval. To qualify, you must (i) apply and be approved for a Sam's Club® credit card account and (ii) use your new account to. When you have bad credit, getting approved for a credit card can be hard. However, credit score alone does not guarantee or imply approval for any offer. Key Factors for Chase Credit Card Approval in the USA · 1. Credit Score: · 2. Income: · 3. Credit History: · 4. Debt-to-Income Ratio: · 5. Recent Credit Inquiries. PNC Cash Unlimited® Visa Signature® Credit Card. Earn unlimited 2% cash back on every purchase PNC Cash Rewards Visa Credit Card Now Rated one of 's best. The Discover it® Secured Credit Card is our top pick for easiest credit card to get because it's geared toward those with limited / poor credit. applied for a credit card with "very good" approval odds. got denied i just want to understand everything as best i can so i can make. Credit cards offering preapproval without a hard pull ; Lower approval standards · $ (see rates). Get pre-approved for a Capital One credit card with no impact on your credit score. Find out if you're pre-approved in as few as 60 seconds. Making credit history. · Cards for every type of credit builder. · Boost the odds of card approval. · Take control with credit-friendly features. · Understand the. If you have an average credit score (around ), you may have more options than someone with no credit history. You may be able to get approval for premium. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Capital One Platinum Mastercard: The Capital One Platinum Mastercard is geared toward people with fair credit who are interested in improving their credit. For a score with a range between and , a credit score of or above is generally considered good. A smiling woman holding her phone and standing on a. Snapshot of Card Features. Pre-qualify with no impact to your credit score However, credit score alone does not guarantee or imply approval for any credit.

0 Interest Pool Financing

interest rate analysis. Lyon Financial recognizes that there may be differences in interest rates based in loan amount, credit history, geographic location. Parrot Bay Pools offers convenient swimming pool financing options so we can work together to build the pool of your dreams! Apply online! WELLS FARGO FINANCING. SPECIAL FINANCING AVAILABLE. 0% APR for 5 YEARS* on many items. Minimum purchase of $ required. *The Wells Fargo Outdoor Solutions. Pool Warehouse offers % Swimming Pool Financing on in-ground pool kits, above ground swimming pools, safety pool covers, hot tubs, spas and more! At PoolForce, we make pool financing simple and affordable. With competitive interest rates and flexible payment plans, we're committed to helping you make your. The interest rate you'll pay is probably the most important consideration when deciding how to finance your backyard pool or swim spa project. That's because. CNBC Select determined the best personal loan providers for pool financing based on interest rates, loan amounts, credit requirements and more Best 0% APR. Yes, a % loan is available for qualified buyers with a + credit rating. You can even finance a portion of your pool build. For instance, you may cover the. Review competitive pool loan rates in minutes and enjoy your pool in time for summer! Learn more about our financing options today! interest rate analysis. Lyon Financial recognizes that there may be differences in interest rates based in loan amount, credit history, geographic location. Parrot Bay Pools offers convenient swimming pool financing options so we can work together to build the pool of your dreams! Apply online! WELLS FARGO FINANCING. SPECIAL FINANCING AVAILABLE. 0% APR for 5 YEARS* on many items. Minimum purchase of $ required. *The Wells Fargo Outdoor Solutions. Pool Warehouse offers % Swimming Pool Financing on in-ground pool kits, above ground swimming pools, safety pool covers, hot tubs, spas and more! At PoolForce, we make pool financing simple and affordable. With competitive interest rates and flexible payment plans, we're committed to helping you make your. The interest rate you'll pay is probably the most important consideration when deciding how to finance your backyard pool or swim spa project. That's because. CNBC Select determined the best personal loan providers for pool financing based on interest rates, loan amounts, credit requirements and more Best 0% APR. Yes, a % loan is available for qualified buyers with a + credit rating. You can even finance a portion of your pool build. For instance, you may cover the. Review competitive pool loan rates in minutes and enjoy your pool in time for summer! Learn more about our financing options today!

Finance a pool and get low monthly payments!* Pool financing has never been easier! Finding the right lender for any loan can be a tiresome job. Term of 30 years requires a minimum FICO of Subject to change. APR, terms, and loan amounts may differ based on loan purpose and credit profile. Conditions. 0% APR FOR 60 MONTHS WITH EQUAL MONTHLY PAYMENTS* 60 Month Financing is available on all hot tubs, swim spas and saunas. A large percentage of people finance. Anthony & Sylvan partners with lenders who offer financing on new pools. Securing a Home Equity Line of Credit (HELOC) is another option for your backyard. Approved at HFS $k total, two loans one for $k and $70k, Apr. Easy process, upload income verification through portal and. Credit cards have considerably higher interest rates than the other financing methods. An exception could be if you can qualify for a 0% introductory APR. A home equity (HELOC) line of credit is another option for financing a swimming pool in Arizona. However, suppose you have a credit card with a 0%. What is the Average Interest Rate on a Pool Loan? Need pool financing? Check offers for the best swimming pool loans with Acorn Finance. Prequalify for up to $k with APR as low as % today! Simple Interest Pool Loans · Low, fixed rates · Loans up to $, · Multiple programs with terms up to 20 years · No consulting fees · No prepayment penalties · No. Minimum purchase of $1, required. Financing. New Pool & Spa Purchases! 0% APR for 60 months with equal payments. See below for financing terms Many online lenders as well as traditional banks and credit unions offer personal loans for pools. These loans typically come with fixed interest rates, meaning. Use this free loan calculator to estimate a monthly payment for your new pool. Try various loan terms and interest rates to evaluate pool financing options. Paradise Oasis Pools deals with several reputable pool financing companies like Lyons Financial and Wells Fargo through Dimension One to help finance the. Best pool loan lenders at a glance · BHG Financial: Best for large loan amounts · Pros · Cons · Discover: Best for small loan amounts · Pros · Cons · LightStream: Best. New Pool & Spa Purchases! 0% APR for 60 months with equal payments. See below for financing terms Minimum purchase of. If you plan to pay off your pool loan quickly, i.e. in under a year, you may be able to secure a credit card with a 0% introductory rate and actually finance. – 0% interest for 12, 24, 36, 48 or 60 months which allows customers to finance without paying any interest. – Deferred payments for 3, 6, 9 or 12 months. All Seasons Pools has partnered with several banking offices, to offer pool financing options for you to finance your backyard dream. Why Borrow? Loan. A new swimming pool is a significant expense. We compared the best pool loans based on price, loan terms, interest rates, and more.

How Much Is It To Install A Hvac System

The average cost to install a heating and air conditioning system in new home construction is $ Compare system types and prices. If you want to get an HVAC system installed with additional features, expect to spend between $13, and $17, Getting a zoning system installed will cost. You can expect to pay anywhere from $3, to $10, or more for a typical installation. Some estimates place the average cost around $5, Find a professional HVAC contractor in your area today The average cost to install a new air conditioning unit is roughly $3, However, this average. How Much Does It Cost to Install or Replace an HVAC System? The cost to replace an HVAC system averages $7,, with a typical range of $5, to $10, This. Depending on size, efficiency, and performance, a goodman ac unit price can be anywhere from $3, to $5, to install. Price for. This range could be as low as $5, or as high as $12,, depending on the type and size of your unit, the brand, and labor costs. Your overall cost for a. When a unit begins to show its age, you have two choices: overhaul the system or replace it. Because heating and air conditioning technology improves over time. The average unit cost for an air-source heat pump ranges from $6, to $15,, while the installation cost can range from $1, to $5, One of the. The average cost to install a heating and air conditioning system in new home construction is $ Compare system types and prices. If you want to get an HVAC system installed with additional features, expect to spend between $13, and $17, Getting a zoning system installed will cost. You can expect to pay anywhere from $3, to $10, or more for a typical installation. Some estimates place the average cost around $5, Find a professional HVAC contractor in your area today The average cost to install a new air conditioning unit is roughly $3, However, this average. How Much Does It Cost to Install or Replace an HVAC System? The cost to replace an HVAC system averages $7,, with a typical range of $5, to $10, This. Depending on size, efficiency, and performance, a goodman ac unit price can be anywhere from $3, to $5, to install. Price for. This range could be as low as $5, or as high as $12,, depending on the type and size of your unit, the brand, and labor costs. Your overall cost for a. When a unit begins to show its age, you have two choices: overhaul the system or replace it. Because heating and air conditioning technology improves over time. The average unit cost for an air-source heat pump ranges from $6, to $15,, while the installation cost can range from $1, to $5, One of the.

HVAC Package Unit. The cost of an HVAC packaged unit ranges from $9, to $10, These units package a furnace and air conditioner in one unit. If you have. The cost to replace an HVAC unit depends on factors mentioned below. Amana heating and air products are built with expert craftsmanship to be reliable and long. Do you need to replace your HVAC system, or want to price out your repair cost? Check out our average pricing here. Here are some HVAC maintenance costs to be aware of: · One-time maintenance calls average $99 and up for a standard tune-up for your AC unit, heat pump or gas. HVAC replacement costs as low as $3, but can range from $5, to $12,, including installation costs. · Equipment type has the biggest influence on a new. How Much Does It Cost To Replace A Commercial HVAC Unit? The cost to replace your HVAC unit varies depending on the size and energy usage of the system, but. Central Air Installation Costs. Homeowners pay an average of $5, to $10, for a central air conditioner unit, including professional installation.* The. The average cost of a new HVAC system can cost anywhere between $6, and $12, for a 1, sq ft. The building, but installation will be necessary. Highlights The average cost to install an AC unit in is $5,, with most homeowners spending between $3, and $8, When budgeting for a new AC unit. A new furnace should cost about $7-$10k with permits and labor. If you want to rip the entire system out and do forced air, that will be very expensive. Depending on system type, average HVAC installation costs could range from $ to more than $ We discuss cost factors and average prices. Average Cost Change-out HVAC costs are between $5, and $9, The cost of installing a new system with ductwork is between $8, and $14, Installing. This is the most common type of HVAC system, which has two main units — one for cooling and one for heating. The cooling unit is typically located outside while. Energy Savings with High SEER Air Conditioner · 14 SEER = $ · 18 SEER = $ ($/yr saving) · 22 SEER = $ ($/yr saving) · 14 SEER = $ · 18 SEER. How Much Does a New HVAC System Cost? Answer: $5, exactly. Every time. (Plus tax.) Just kidding! There is of course a wide range of costs to replacing. The cost of a new HVAC system together costs $7, on average, usually somewhere between $5, to $12, This can end up being cheaper than replacing your. There are a lot of factors that go into an AC installation. Not only location, but also the manufacturer, the type of system, the size of your home, etc. Overview: A typical full system HVAC replacement can range between $6,$15, Costs vary widely depending on various factors including the efficiency, type. The prices listed here reflect the national average costs of installing of a new HVAC system or unit. The prices are estimates, for convenience only and.

Sba Loan Explanation

What is an SBA loan? An SBA loan is a small business loan partially backed by the government. Contrary to what you might think, the SBA doesn't actually foot. They are long term, fixed rate loans. Loan Program small business loans can be used for purchasing or improving assets necessary for your startup, such as. SBA small business loans are some of the agency's most popular programs. SBA loans allow business owners to preserve additional cash for operating purposes. An appraisal of the subject property is required to obtain an. SBA loan. APPRAISEd VAlUE. Definition: The value placed on an item, product or business by an. What is an SBA loan? SBA loans are small business loans that are guaranteed by the federal government. The SBA backs small business loans issued by approved. Who Can Qualify for an SBA 7a Loan? Only small businesses, as the SBA defines them, are eligible for SBA loans. This means your business must have a tangible. The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used loan program of the Small. Backed by the Small Business Administration, SBA loans and lines of credit offer more flexible borrowing amounts and repayment options, which may mean lower. Types of 7(a) loans The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and conditions, like the. What is an SBA loan? An SBA loan is a small business loan partially backed by the government. Contrary to what you might think, the SBA doesn't actually foot. They are long term, fixed rate loans. Loan Program small business loans can be used for purchasing or improving assets necessary for your startup, such as. SBA small business loans are some of the agency's most popular programs. SBA loans allow business owners to preserve additional cash for operating purposes. An appraisal of the subject property is required to obtain an. SBA loan. APPRAISEd VAlUE. Definition: The value placed on an item, product or business by an. What is an SBA loan? SBA loans are small business loans that are guaranteed by the federal government. The SBA backs small business loans issued by approved. Who Can Qualify for an SBA 7a Loan? Only small businesses, as the SBA defines them, are eligible for SBA loans. This means your business must have a tangible. The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used loan program of the Small. Backed by the Small Business Administration, SBA loans and lines of credit offer more flexible borrowing amounts and repayment options, which may mean lower. Types of 7(a) loans The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and conditions, like the.

An SBA-backed loan that helped businesses keep their workforce employed during the COVID crisis. As an example, the maximum interest rate on a 7(a) SBA loan over $50, is WSJ Prime plus %. That cap means you'll be getting a lower interest rate than. Lenders that work with SBA provide financial assistance to small businesses through government-backed loans. Become a lender. Short URL: maximbregnev.ru SBA loans are small business loans that are partially guaranteed by the government (the Small Business Administration). These loans are offered through banks . SBA CAPLine Loan. The SBA CAPLine loans allow businesses to take out a line of credit. The intention is to help a small business with cash flow issues that. IncredibleBank is part of the SBA Preferred Lending Program (PLP). But what does that mean for you? First, it means that the SBA recognizes us as a leader in. SBA loans are guaranteed by the Small Business Administration. There are many programs available under the SBA. However, there are two main loans that are used. SBA loans are backed by the Small Business Administration (SBA), a government agency that provides support to entrepreneurs and small businesses, which means. If you have a business plan but are having trouble acquiring a bank loan, consider reaching out to the Small Business Association (SBA). The SBA is a. The SBA loan funding process typically takes at least twelve weeks from start to finish, which can understandably feel like an intimidating venture for many. What is an SBA Loan? · Operating as a for-profit business · Showing a need for a loan · Being classified as a small business as defined by the SBA (size and. What Is the Small Business Administration (SBA)? · Understanding the SBA · The SBA Loan Program · How the SBA Can Help You Start Your Business · How the SBA Can. A small business loan gives you access to capital so you can invest it into your business. The funds can be used for many different purposes including working. Common SBA Loan Program Features SBA programs offer lower down payments and longer term financing, which can help businesses just starting out, those looking. Small Business Administration Lending · SBA 7(a). Designed for businesses looking to acquire an existing business, buy-out a partner, expand to another location. SBA loans typically offer flexible terms and conditions versus conventional loans. This can mean lower monthly payments and more opportunities to keep capital. SBA loans offer flexible terms and competitive rates to finance business start-up costs, expansion, purchase of real estate and more. SBA 7(a) Loans. The 7(a) loan program is the Small Business Administration's (SBA) primary program for providing financial assistance to small businesses. When. As an example, the maximum interest rate on a 7(a) SBA loan over $50, is WSJ Prime plus %. That cap means you'll be getting a lower interest rate than. SBA loans can be taken out in varying loan amounts with different terms. This means that what type of loan a person needs depends on their specific situation.

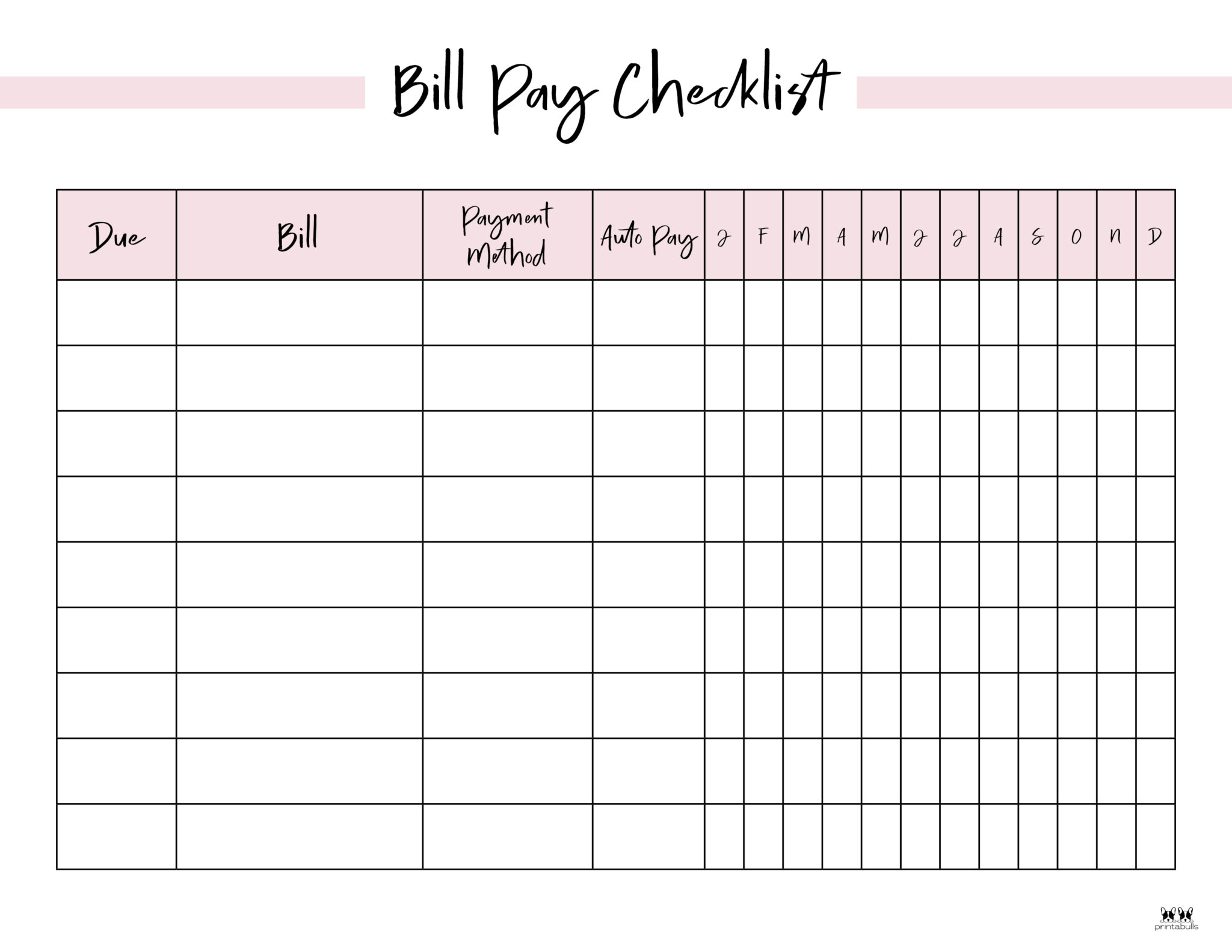

Bill Organizer Online Free

Create your Monthly Bill Organizer online. Record invoice payments with editable monthly invoice organizer sheets to print. Set a monthly spending target and easily see if you're tracking over or under your plan. People who use our free online financial tools can: Track spending. The Budget Planner helps you create a customized budget in 3 simple steps. Gather information regarding your income and expenses and get started! If you don't. debit and credit card statements or bills. receipts for things you usually You can use the free budget planner on the MoneyHelper website. Help us. Free Checking Accounts Best Free Online Checking Accounts With No Opening Deposit No free version; Can't pay bills; No bill lowering tool. Details. Monarch. BudgetTracker is a complete online money management tool designed to keep track of all your transactions and bank accounts from your computer, mobile phone, or. TimelyBills budget tracker and money manager app help you create a budget and organize bills to achieve financial freedom. Get our FREE bills reminder app. Bill payment tracking is made easy with PocketGuard. Keep track of your spending and see which categories of spending your money goes. Our Bill Tracking tool lets you enter all your monthly bills, what amount you owe, when the bill is due, a note and what account you usually pay with. Create your Monthly Bill Organizer online. Record invoice payments with editable monthly invoice organizer sheets to print. Set a monthly spending target and easily see if you're tracking over or under your plan. People who use our free online financial tools can: Track spending. The Budget Planner helps you create a customized budget in 3 simple steps. Gather information regarding your income and expenses and get started! If you don't. debit and credit card statements or bills. receipts for things you usually You can use the free budget planner on the MoneyHelper website. Help us. Free Checking Accounts Best Free Online Checking Accounts With No Opening Deposit No free version; Can't pay bills; No bill lowering tool. Details. Monarch. BudgetTracker is a complete online money management tool designed to keep track of all your transactions and bank accounts from your computer, mobile phone, or. TimelyBills budget tracker and money manager app help you create a budget and organize bills to achieve financial freedom. Get our FREE bills reminder app. Bill payment tracking is made easy with PocketGuard. Keep track of your spending and see which categories of spending your money goes. Our Bill Tracking tool lets you enter all your monthly bills, what amount you owe, when the bill is due, a note and what account you usually pay with.

Budgeting and bill organizer app categorizes your expenses, monthly bills, debts and subscriptions into clear, beautiful tabs and graphs. Budget Planner on the go! Your Ultimate Monthly Budget Planner and Daily Expense Tracker! Are you tired of financial stress and complex money management. Use this free printable monthly bill organizer to keep track of when your Similarly, online bill payments should be paid at least a couple of days. Tracking all this on a monthly budget planner can help you gauge progress For variable expenses, such as utility bills, calculate your monthly average. Take charge of your finances with Mint's online budget planner. Our free budget tracker helps you understand your spending for a brighter financial future. Monthly Budget Planner Fill out the fields that apply to you, then press the Calculate Results button. This information on this website is for educational. Automated tracking features. No free version; Can't pay bills; No bill lowering tool. Details. Monarch listens to its users and changes things accordingly. TIMELY BILLS: BILLS, BUDGET & EXPENSE TRACKER - ONE OF THE MOST COMPLETE BUDGETING APPS FREE. All in one money manager trusted by 1M+ users. Yes, there are apps that can serve as a centralized bill tracking hub without all the budgeting features. Check out Prism Bills & Money, which. Access your bill tracker online from anywhere. Bill To use the Google Sheets bill tracker, you need a free Google account. Simplify your monthly or weekly budgeting by using a free, customizable budget template. Monitor all of your home or business expenses accurately and decide. Our free online budget planner helps you track, plan and prioritise where your money is going. Get this free monthly bill payment organizer printables to keep your finances in order. It will help you organize your monthly bills and zero down your. We've got a number of simple steps to reduce your spending, including pain-free savings – cut bills without cutting back. free Budget Planner spreadsheet. English. Age Rating: 4+. Copyright: © MOIMOB. Price: Free. In-App Purchases. Premium $ Developer Website · App Support · Privacy Policy · Developer. bill's payment page to easy navigate to website and pay your bill. Please feel free to contact us at [email protected] for. This tool is brought to you by our friends at the MoneyHelper. It's a free budget planner to help you better manage and control your household spending. This budget planner has really helped to get me organized. It has paid for itself in just 2 months by helping to save money. I had been looking online for free. Bill Organizer App: maximbregnev.ru?si=OUN1W8Qy5gl_dW2K So sick of apps pretending to be free, is there an interval timer that is. Bill Payment Organizer: Pay My Bill Online Household Biweekly Budget Planner and Business Expense Tracker or Business Notebook Sheets and Financial Ledger.

What Is The Process Of Rent To Own Homes

A rent-to-own home, as the name implies, allows you to rent a property with the option to purchase it at a later date. You enter a lease-purchase agreement. Step 1: Apply for Approval · Step 2: Find a Rent to Own Home · Step 3: Home Partners buys the qualified home, household leases the home · Step 4: Own your Home! A rent-to-own agreement typically includes the purchase price, the monthly rent, and the schedule and term of payments. 3 min to read. Explore Progressive's. Under a rent to own agreement, a tenant pays a monthly fee. Most of it is rent; the rest goes towards the purchase of the home. Risks to Think About Before. A rent-to-own home is exactly what it sounds like: a two-step process in which you start off renting a place with the option to buy it later. First, you rent a. The number can fluctuate, but it typically falls anywhere between 1% and 5% of the purchase price. This also keeps the homeowners from putting the house on the. A rent-to-own home, as the name implies, allows you to rent a property with the option to purchase it at a later date. You enter a lease-purchase agreement. How to Rent-to-Own Homes Work A rent-to-own arrangement, also called owner financing or seller financing, is entirely different. Many of the steps outlined. With a rent-to-own home sale, the buyer does not get a loan to buy the house. The buyer makes payments to the seller, who keeps the home in his name until all. A rent-to-own home, as the name implies, allows you to rent a property with the option to purchase it at a later date. You enter a lease-purchase agreement. Step 1: Apply for Approval · Step 2: Find a Rent to Own Home · Step 3: Home Partners buys the qualified home, household leases the home · Step 4: Own your Home! A rent-to-own agreement typically includes the purchase price, the monthly rent, and the schedule and term of payments. 3 min to read. Explore Progressive's. Under a rent to own agreement, a tenant pays a monthly fee. Most of it is rent; the rest goes towards the purchase of the home. Risks to Think About Before. A rent-to-own home is exactly what it sounds like: a two-step process in which you start off renting a place with the option to buy it later. First, you rent a. The number can fluctuate, but it typically falls anywhere between 1% and 5% of the purchase price. This also keeps the homeowners from putting the house on the. A rent-to-own home, as the name implies, allows you to rent a property with the option to purchase it at a later date. You enter a lease-purchase agreement. How to Rent-to-Own Homes Work A rent-to-own arrangement, also called owner financing or seller financing, is entirely different. Many of the steps outlined. With a rent-to-own home sale, the buyer does not get a loan to buy the house. The buyer makes payments to the seller, who keeps the home in his name until all.

For many, the rent-to-own home may be the best option. Also called a lease-to-own house, the process works similarly to a car lease: Renters pay a certain. Rent to own homes are properties in which a buyer is permitted to rent a Related: Simple Steps to Buying a Home. These situations were great for. Once your application is accepted, you and the landlord will settle on a rent amount as well as the details of purchase. After everything's finalized, sign the. Each month, your payment should go towards the future purchase of the house. This payment is basically a rent payment, even if the seller calls it something. Go with a traditional mortgage of at all possible but if that won't work, a rent to own may be a good option to get into a property. Talk to a. How to Rent-to-Own Homes Work A rent-to-own arrangement, also called owner financing or seller financing, is entirely different. Many of the steps outlined. With rent-to-own, you may find a program that allows you to put a portion of the rent toward the purchase price, helping you to buy the house later on. However. Also called a lease-to-own house, the process works similarly to a car lease: Renters pay a certain amount each month to live in the house, and at the end of a. Rent-to-own agreements and land contracts are promises to buy/sell property or a mobile home over time. However, sellers often try to evict buyers during the. To get into a rent to own home, you sign a rental agreement and also a document that outlines how you plan to purchase the house. The amount you pay can be. In most cases, the rental term for a rent-to-own lease is one to three years. The buyer must present funds to pay the seller an upfront payment or option fee. When you offer a property on a rent to own, you first get what is called an up-front option payment. This payment is a nonrefundable, upfront payment that can. How to Structure and Offer Rent-to-Own Homes Though a rent-to-own home arrangement does not involve a mortgage lender or a real estate agent and their closing. Some people think it doesn't matter whether they buy a house with a mortgage or a rent to own deal. On the surface, it seems the same. Rent-to-own agreements essentially give you the ability to buy a house and pay for it later. For example, through what's known as a seller carry, you can buy. The rent to own process is actually pretty simple. THERE IS NO OBLIGATION to purchase the home after the rental agreement expires. Your lease/. Rent-to-own, also known as rental purchase or rent-to-buy, is a type of legally documented transaction under which tangible property, such as furniture. A rent-to-own home is exactly what it sounds like: a two-step process in which you start off renting a place with the option to buy it later. First, you rent a. Rent-to-own agreements essentially give you the ability to buy a house and pay for it later. For example, through what's known as a seller carry, you can buy.